6 Benefits of Using Contract Management Software for Your Insurance Contracts

March 9th, 2023

Although most people don’t often refer to them in this way, insurance policies – for healthcare or assets – are a kind of legal contract. As such, they must contain all the legal elements of contracts such as:

- Offer and acceptance: Applications for insurance policies are offers from prospective purchasers, and accepting an application is legal approval.

- Consideration: Policyholders effect consideration – the exchange of money, goods, or services – by paying their premiums.

- Legal capacity: Both insurance providers and their customers must be of sound mind and majority age to contract policies.

- Legal purpose: Policies must not require or encourage any illegal activities.

As issuers of contracts, insurance companies can greatly benefit from the use of contract management software to streamline and refine the process of writing policies. In this guide, you’ll learn what contract management is and how your insurance company can benefit from it.

Key Takeaways

- Insurance policies of any kind are legally binding contracts.

- Insurance companies must develop effective contract management practices to ensure efficient and compliant operations.

- Contract management software is a powerful and beneficial tool for implementing contract management in insurance companies.

😉 PS: Register for webinars about contract management trends, technology, and other topics with Contract Logix CLICK HERE.

What is Contract Management?

Contract management refers to the set of business processes and practices organizations use to orchestrate the creation, negotiation, maintenance, and execution of contracts. Contract management makes contract processes more efficient, mitigates risk, and ensures compliance.

Fundamental contract management practices include:

- Designing workflows that route contracts efficiently between different, successive users

- Establishing approved language and clause libraries

- Identifying and assessing contract risks

- Delineating tasks and tracking obligations

- Maintaining sufficient audit trails

Many organizations divide contract processes into stages – requests, authoring, negotiation, approval, execution, maintenance, and renewal. These stages represent the contract lifecycle, and organizations call processes tailored for these stages of contract lifecycle management (CLM).

Effective CLM requires a high level of organizational coordination. For large organizations that handle complex contracts, the most reliable way to implement CLM successfully is through the use of contract management software. Contract management software is a cloud-based application with a suite of contract management tools and a secure repository for contracts and related documents. Authorized users can access the repository to work on insurance contracts with ease.

Benefits of Contract Management Software for Insurance Companies

Contract management software provides insurance companies with several important operational benefits.

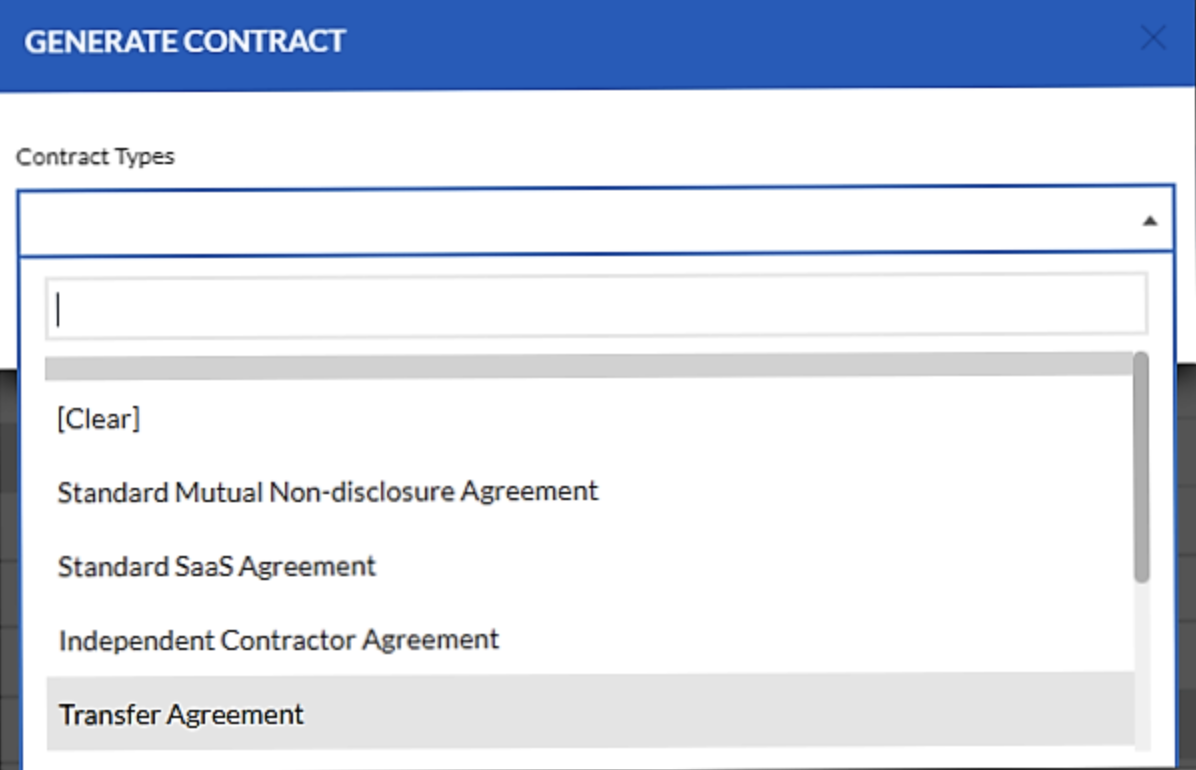

1. Customized Templates for New Policies

Creating new insurance contracts from scratch every time is a great example of reinventing the wheel. Insurance policies are no exception. Contract management software can create highly customized templates for the range of policies your company issues. With preapproved language and standardized clauses and definitions, agents can quickly write new policies quickly that comply with the law and your company’s regulations.

2. Improved Organizational Transparency

Insurance companies issue a high volume of contracts. If your company employs hundreds to thousands of agents, maintaining effective oversight of ongoing policy writing and ensuring that agents process new applications on time can easily become too much to monitor.

To solve this, contract management software provides live visibility into the status of all insurance contracts stored in the system. This reduces the chance of miscommunication over the status of policy applications and helps resolve issues before they escalate.

3. Maximized Data Security

Storing policy documents or any other kind of contract in various systems such as work computer hard drives and email attachments greatly increases the risk of accidental exposure or data breach. Across industries, 91% of data breaches begin with email exploits.

SOURCE: OnlineComputerTips via YouTube

Cloud-based contract management platforms store insurance contracts in a central, secure documents repository, providing the highest level of security for your company’s data. These include 256-bit end-to-end encryption for data in storage and in transmission and multifactor authentication (MFA), which multiple unique fields to identify users.

4. Automated Contract Workflows

Insurance policies often require the input of multiple parties. When contributing policy authors must decide where to send their work once completed, it leads to unnecessary downtime, and users frequently send documents to the wrong person.

Establishing workflows that automatically identify the next right user for contracts based on the completion of specific tasks eliminates these bottlenecks. This allows your company to map all policy-related workflows and automate the routing of work through your organization.

5. Electronic and Digital Signatures

Exchanging hard copies by mail or scheduling signing meetings to obtain wet signatures can significantly prolong contract execution times. Contract management software supports electronic and digital signatures, enabling faster contract execution.

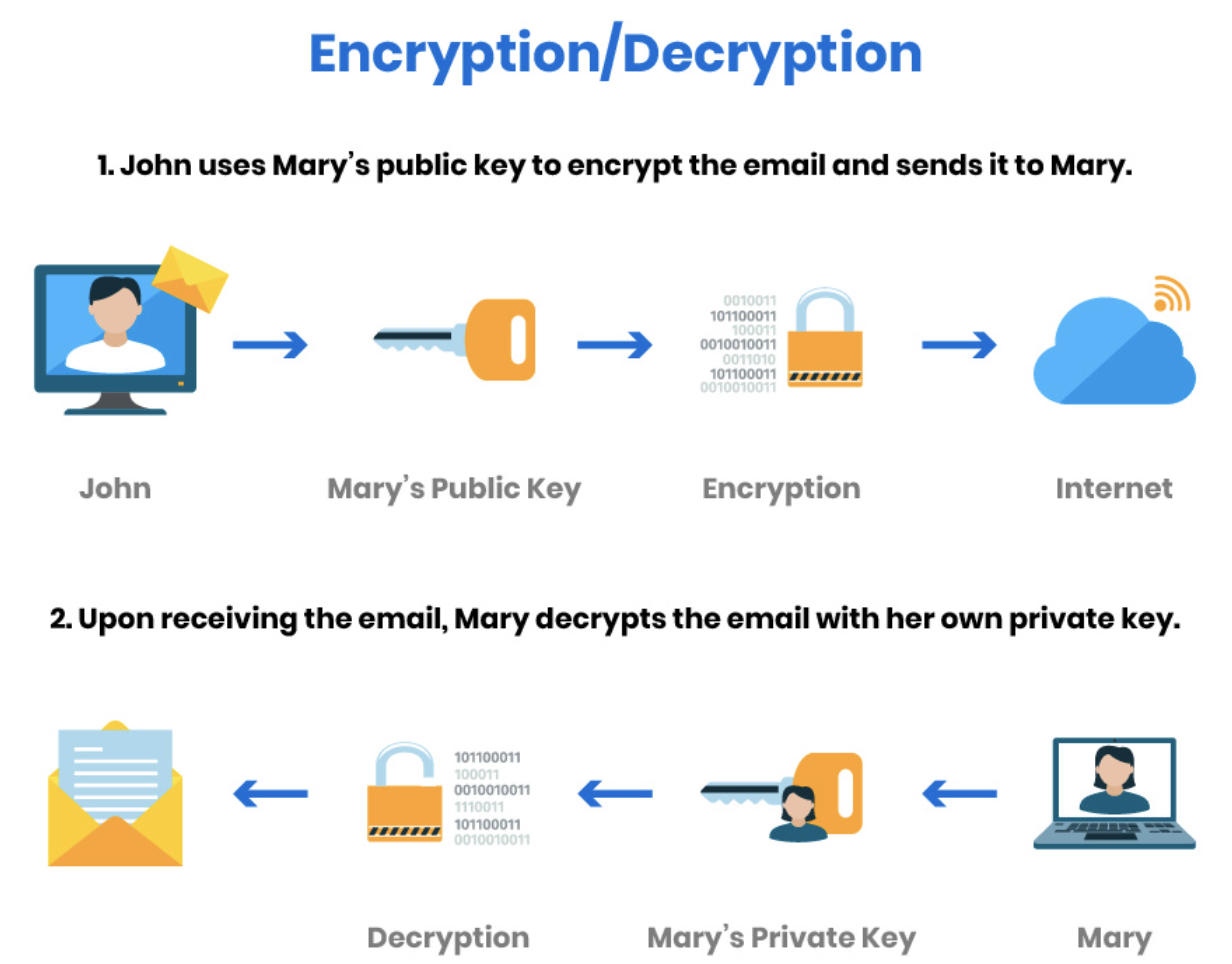

Image Source: www.infosec.gov

Electronic signatures replace traditional paper signatures with digital signatures. Using electronic signatures allows signing parties to sign contracts instantly and from any location, greatly reducing execution times.

Digital signatures use encryption technology that users can apply to electronically signed documents to guarantee that no single party can alter a contract after signing. They use an encryption format called public key infrastructure (PKI), which registers encrypted digital assets with a third-party registration authority that issues keys to all signing parties.

6. Automated Notifications

SOURCE: Online Computer Tips via YouTube

Insurance contracts involve many time-sensitive components. When agents work on multiple policies simultaneously, they can easily overlook returned requests and impending deadlines. Insurance companies can configure contract management software to issue automatic notifications for a wide variety of events, such as completed tasks, deadline reminders, and new requests.

Contract Logix: Optimize Your Contracting Processes with the Right Contract KPIs

Contract Logix’s powerful contract management software gives insurance companies the tools and capabilities necessary to implement best in class contract management processes and practices. In fact, Contract Logix works with many insurance companies to digitally transform the way the manage contracts with speed, automation, and AI. To learn more, request a demo of Contract Logix’s industry-leading CLM platform.

Looking for more articles about Contract Management? Check out our previous article “Enterprise Contracting: Processes and Best Practices“.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence