Should Your Brokerage Firm Invest in Third-Party Contract Lifecycle Management?

June 16th, 2023

How effectively is your insurance brokerage firm managing its contracts? Insurance agencies regularly generate a large number of contracts. Your firm can try to manage those contracts manually, but the more contracts you generate, the harder that is to do.

For many brokerage firms, the better solution is to employ third-party contract management software, such as Contract Logix. This service automates the entire contract process and enhances your tracking of terms, conditions, and deliverables in the contracts that drive your firm’s business.

Key Takeaways

- Third-party contract management solutions automate the entire brokerage contract lifecycle.

- Brokerage firms benefit from a streamlined process that minimizes manual work and reduced errors.

- Third-party solutions standardize and track terms and conditions, eliminate missed deadlines, and enable easier access and auditing.

- Contract management software improves reporting and analysis, ensures legal compliance, and reduces costs.

🤫 P.S.: Discover what contract management software is and how it benefits you HERE.

What is Third-Party Contract Management Software?

Contracts drive the entire insurance industry, which makes effective contract management a necessity. Rather than managing all contracts manually, automating the entire process with contract management software can free your agents to focus on clients.

Third-party contract management software automates the entire brokerage contract process from start to finish. It simplifies contract creation, negotiation, editing, execution, deadline tracking, and performance monitoring. By digitizing the contract process, you minimize human errors and eliminate unnecessary paper usage throughout your firm.

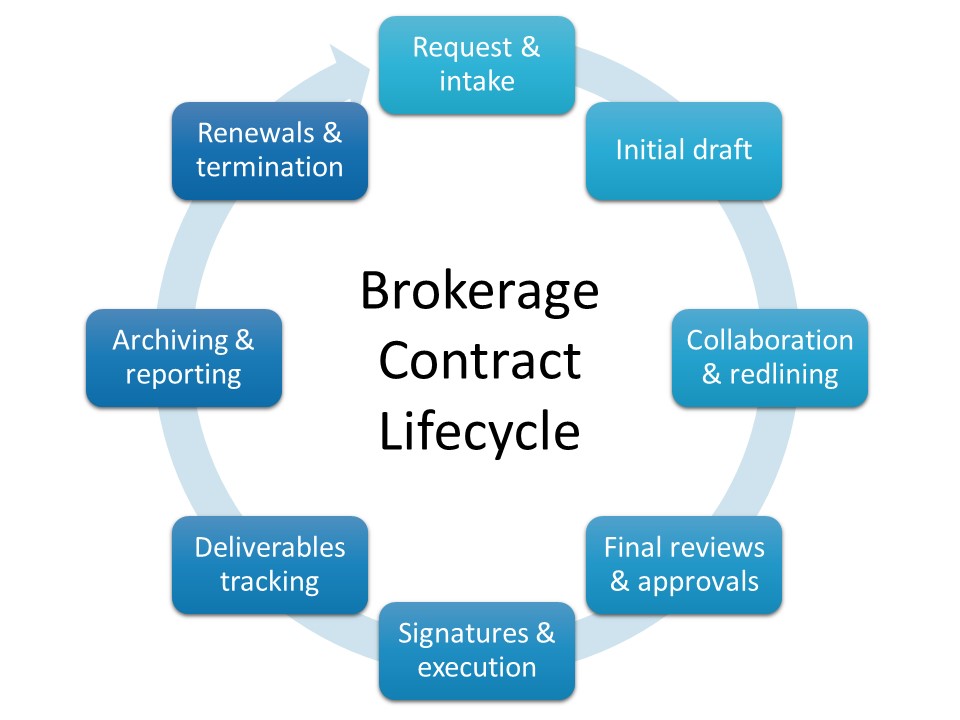

Here’s how brokerage firms use contract management software throughout the contract lifecycle:

- Request and intake: The entire contract initiation process is automated and centralized. All you have to do is fill in an onscreen form to initiate a contract request.

- Initial draft: Simply choose an appropriate template from a template library and insert pre-approved terms and clauses.

- Collaboration and redlining: All collaboration and editing process is done electronically, avoiding paper routing. Contract files are automatically routed to the proper individuals for their input and redlining.

- Final reviews and approvals: After successful negotiation, contracts are electronically routed for reviews and approvals, which are all done onscreen.

- Signatures and execution: The use of electronic signatures speeds up contract execution and automatically tracks it. (E-signature contracts average a 37-minute signing time!)

- Deliverables tracking: Deadlines are automatically tracked within the system, with automatic deadline notifications.

- Archiving and reporting: Contracts are stored electronically, eliminating cumbersome and expensive physical storage. The use of a centralized digital contract repository makes it easy to retrieve contracts and generate detailed contract performance reports.

- Renewals and termination: The system tracks all end dates automatically tracked for easy contract renewal or expiration decisions.

Third-party contract management software digitizes and streamlines a formerly manual and physical process. All contracts are now electronic, and they’re routed electronically. The new process is easy to integrate into your firm, as it does everything you’re currently doing (and a lot more), just digitally. It streamlines the entire process and makes it easy to get more use from the contracts you sign.

Why Insurance Brokerage Firms Need Third-Party Contract Management

Managing the numerous contracts insurance brokerage firms generate takes much time and effort. Tracking a contract through its stages, getting the approvals and signatures, securely storing all paper contracts post-execution, and providing easy access to the information stored within can be challenging.

In addition, insurance agencies face strict governmental reporting requirements. To comply with governmental and industry regulations, you need access to contract data and easy retrieval during audits. Trying to find the specific information you need in paper contracts locked away in a storage room can be next to impossible.

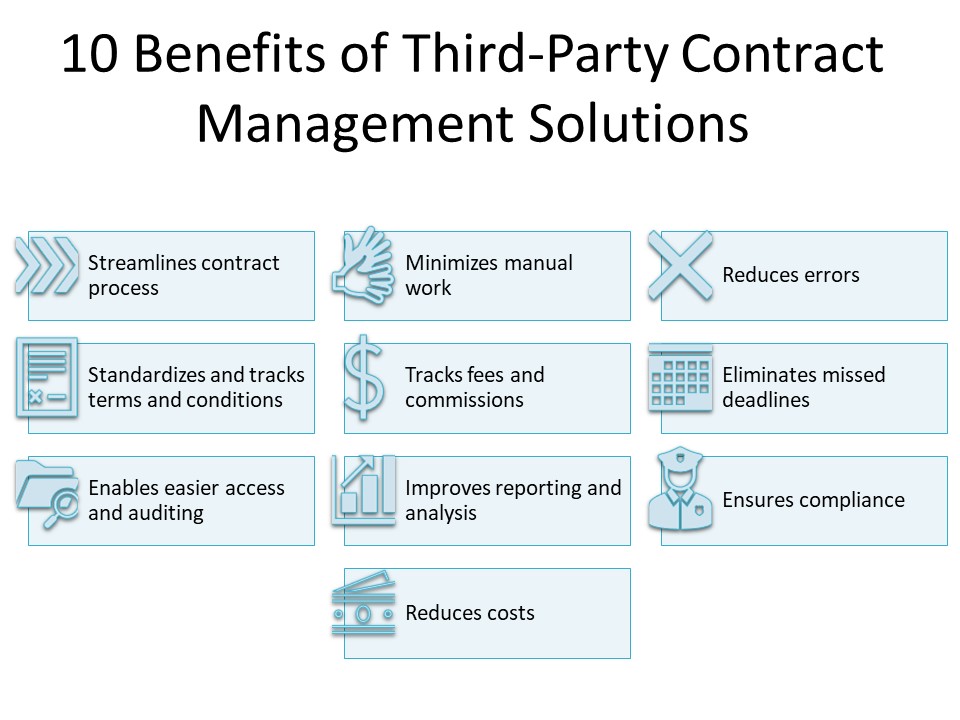

Third-party contract management solutions alleviate these issues and make your life much easier. Consider these 10 important benefits of contract management software for your brokerage firm.

1. Streamlines the Insurance Contract Process

By automating the contract lifecycle, you get improved efficiency and faster execution. This lets you sign more contracts in less time.

2. Minimizes Manual Work

With an automated contract management solution, contract creation is faster and easier, since you don’t have to write each contract from scratch. You no longer have to spend time physically routing contracts from one office to another. You spend less time on dreary manual tasks and more time working with clients.

3. Reduces Errors

Contract management software uses preapproved contract templates and clauses. This, along with other automated operations, prevents manual errors from creeping into the process.

4. Standardizes and Tracks Terms and Conditions

Standardized contract templates ensure no single contract goes beyond what your firm approves. The centralized electronic contract repository also makes it easy to examine and track the terms and conditions of every contract you sign.

5. Tracks Fees and Commissions

Do you know what fees and commissions are due on each contract? Contract management software works with your other systems to ensure that you know exactly what’s due and when with each contract.

6. Eliminates Missed Deadlines

It’s difficult to track every single deadline and deliverable in physical contracts. Digitizing all contracts makes that task easy. Not only are all deadlines and deliverables electronically tracked, but you’re automatically notified of all important upcoming dates.

7. Enables Easier Access and Auditing

With all contracts and related documentation stored in a centralized digital repository, searching for and retrieving specific information or individual contracts becomes straightforward. This also makes it easier to audit your contracts if necessary.

8. Improves Reporting and Analysis

By electronically storing all your brokerage contracts, contract management software makes it easy to generate reporting customized to your firm’s specific needs. That makes it easier for you to conduct in-depth analysis of each contract’s performance.

9. Ensures Compliance

More than half of all executives say that regulatory compliance is a top priority for their firms. By electronically tracking all stages of the contract lifecycle and storing documents electronically, third-party solutions ensure stronger compliance with all governmental and industry regulations and requirements. It’s a lot easier than trying to ensure compliance from reams of paper documents.

10. Reduces Costs

By reducing labor and paper costs, third-party contract management solution help your firm save money. You can also reduce costs by identifying and renegotiating poor-performing contracts.

Let Contract Logix Provide Contract Management for Your Insurance Brokerage

To more effectively manage your brokerage contracts, turn to the contract experts at Contract Logix. Our CLM solutions automate the entire contract lifecycle. You get a centralized digital contract repository, automatic tracking and notifications, detailed reporting and analysis, and a more efficient workflow. It’s an optimal way to simplify insurance contract management.

Contact Contract Logix to learn more about insurance brokerage contract management.

Looking for more contract management insights? Check out our latest blog post on “How to Create Enforceable and Effective Remote Contracts”.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence